Award-winning PDF software

2022 ct income tax s Form: What You Should Know

Real estate transactions can be the purchase or the sale of real estate. Generally, a capital loss will be recognized on the sale of your main home if you received more than 250,000 in cash. However, your gross loss on a sale may be more complicated if there are some significant moving parts, such as when your home is moved to a new location. To simplify your understanding and understanding, we've taken the basic steps you must follow when you wish to deduct your real estate taxes. First, determine if there are any exemptions, deductions, or tax credits for your situation. Next, calculate your estimated real estate taxes due (or at least be able to estimate it). Once you've obtained and evaluated all the information, including the information in your 1099-S, submit your actual records as described under Step 2 to calculate any net tax that you would owe on your property. You will be able to complete the IRS form for the amount of net tax you owe on your transaction. You must file the form by the deadline, even if you do not owe any additional tax. This will help protect you from being assessed interest on additional interest, as required by the FICA tax. Finally, you'll be able to fill out the form and submit it to the IRS for your annual tax reporting. IRS Form 1099-S | Real Estate Transactions & Your Taxes A real estate transaction in the United States generally creates a tax liability for the purchaser, and the seller. Most transactions are classified as “regular” sales, with sales of new and second houses constituting the vast majority of real estate sales. If you purchase a home, you are generally the seller. The difference between real estate transactions and transactions of most other types of property is that real estate sales typically qualify for the following tax credits: Interest deduction Net operating loss deduction Home equity line of credit Homebuyer health care credit The tax treatment of real estate sales differs slightly depending upon whether you are a joint tenant, part-owner, or an owner-occupant. Most real estate transactions in the United States are taxed as personal, not real estate, income. Your income, after any federal and state taxes, is generally treated as personal income and is not subject to Federal and State income tax. However, if you sell your home at a loss and take a mortgage or personal loan on it, your income for the year (before any depreciation of the home) will be reported as personal income under IRC 6130.

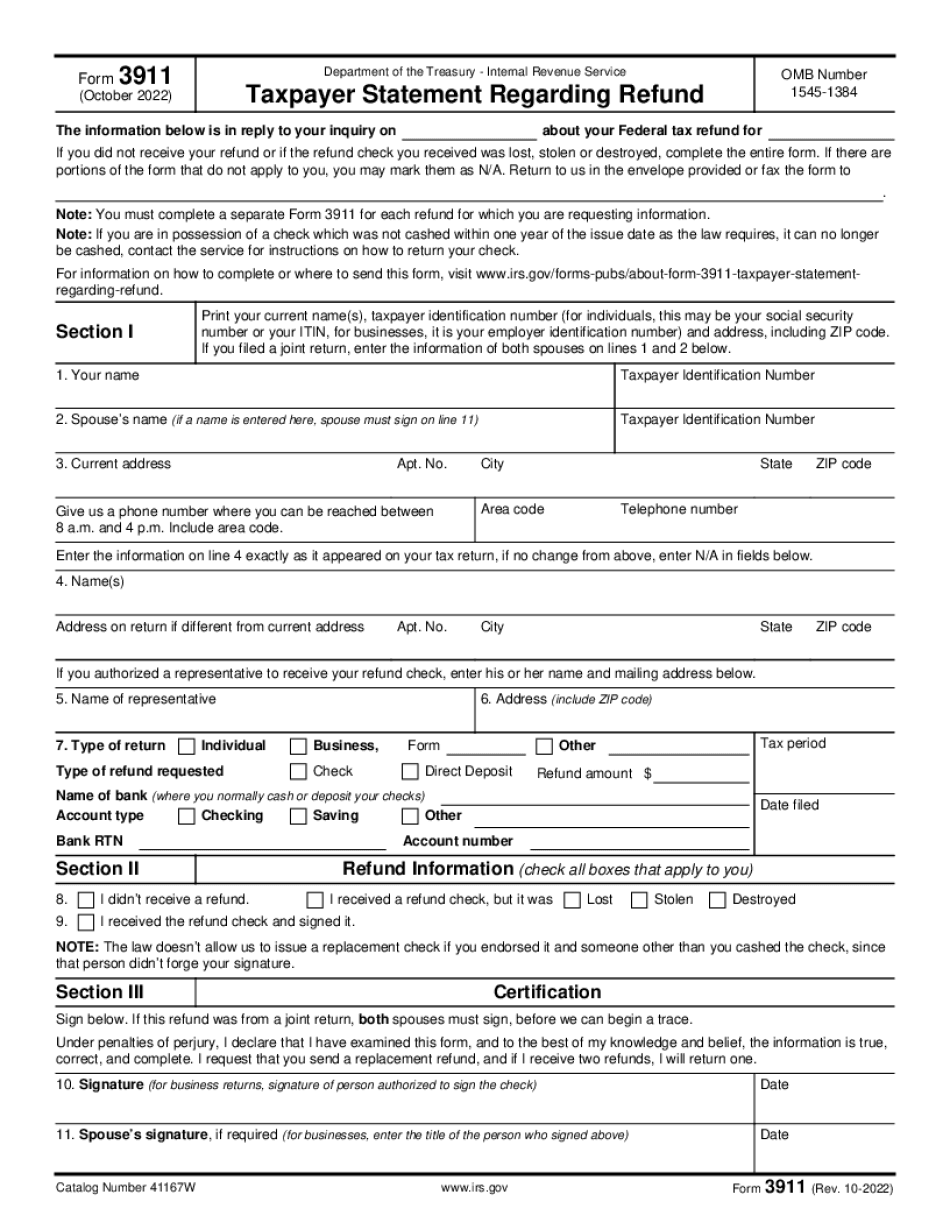

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 3911, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 3911 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 3911 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 3911 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.