It's the stimulus package to bail you out of that holiday spending debt. Income tax refund season is upon us, and Walmart is making a power play to bring in more customers. - The program is called "Direct to Cash," and it allows customers to receive their income tax refund from Walmart instead of cashing a check or waiting for it in the mail. - The program is open to those expecting up to $7,500. Here's how it works: customers who decide to use the program go to one of 25,000 tax preparers around the country (such as H&R Block or Jackson Hewitt) and they file your taxes. - Then, the tax preparer sends a confirmation code to your email. Customers bring the email and an ID to Walmart, which then pays you in cash. - The fee for those without a checking account and looking to cash the refund check can be extremely high, more than two percent of the total. However, the Walmart program only charges a seven-dollar fee. - But the potential catch of the new program is paying the tax preparer, which on average costs about $246, according to the National Society of Accountants. - If you make less than $53,000 a year, you can get this service for free. Walmart calls this program a win-win, offering customers an efficient and cheaper way to get their money and putting more customers in the tax preparer offices and Walmart. - Daniel Eckhart, the senior vice president for Walmart's services, states, "It's always a good thing to have customers in our stores who have jingles in their wallets and their pockets." - Walmart's "Direct to Cash" program is just the latest venture for America's largest retail giant, which has struggled with growth as of late. - It has...

Award-winning PDF software

Tax refund check ripped Form: What You Should Know

Banks don't usually accept ripped or torn checks if they are over 50 years old; they will even hold the returned check as evidence of theft (if you have no bank account, and you don't already have a replacement check available). However, it may be possible to deposit a ripped check and get a new check issued. The Internal Revenue Service (IRS) generally doesn't allow people to use ripped checks to pay federal taxes. And, while most banks are happy to issue a new check in the event of a missed payment through their customer service center, you are still better off writing a check, taking a check off the shelf, and writing a check. If you don't want your bank to hold your lost check—if you have some other way of paying your taxes—here are some ideas: Don't forget to send the original tax form. You may not be able to submit the damaged, torn check to your bank just to get a new check; the money would still have to be collected from you by someone else (such as IRS or the state). But, you may be able to send a scanned copy of the form by mail. Some states allow tax-deferred savings accounts and have bank accounts that provide free checking to low-income families. See the IRS Tax Shelter Guide for more information. Pay your taxes by direct deposit. If this is something you've considered doing, you may also want to check with your bank to see if the bank will allow you to pay taxes in-person at a bank location. In some states, if you apply for unemployment benefits, you can get a refund check through the state unemployment agency. The Internal Revenue Service also may allow you to have your bank hold the check, but this may not be an easy way to do it. You can also write a check, even if your bank has no ability to accept a new check, but you will still need to collect the tax due from the government. If you write a check in person with your local credit union, it may not be possible to get a different check. However, don't write your check through a personal check cashing service like American Express. Cashing a check from a service such as American Express may make things worse in terms of refund issues for your return. For other ways to pay your taxes—other than directly through the mayor's bank—check out this list of tips for paying your taxes. Tax return errors.

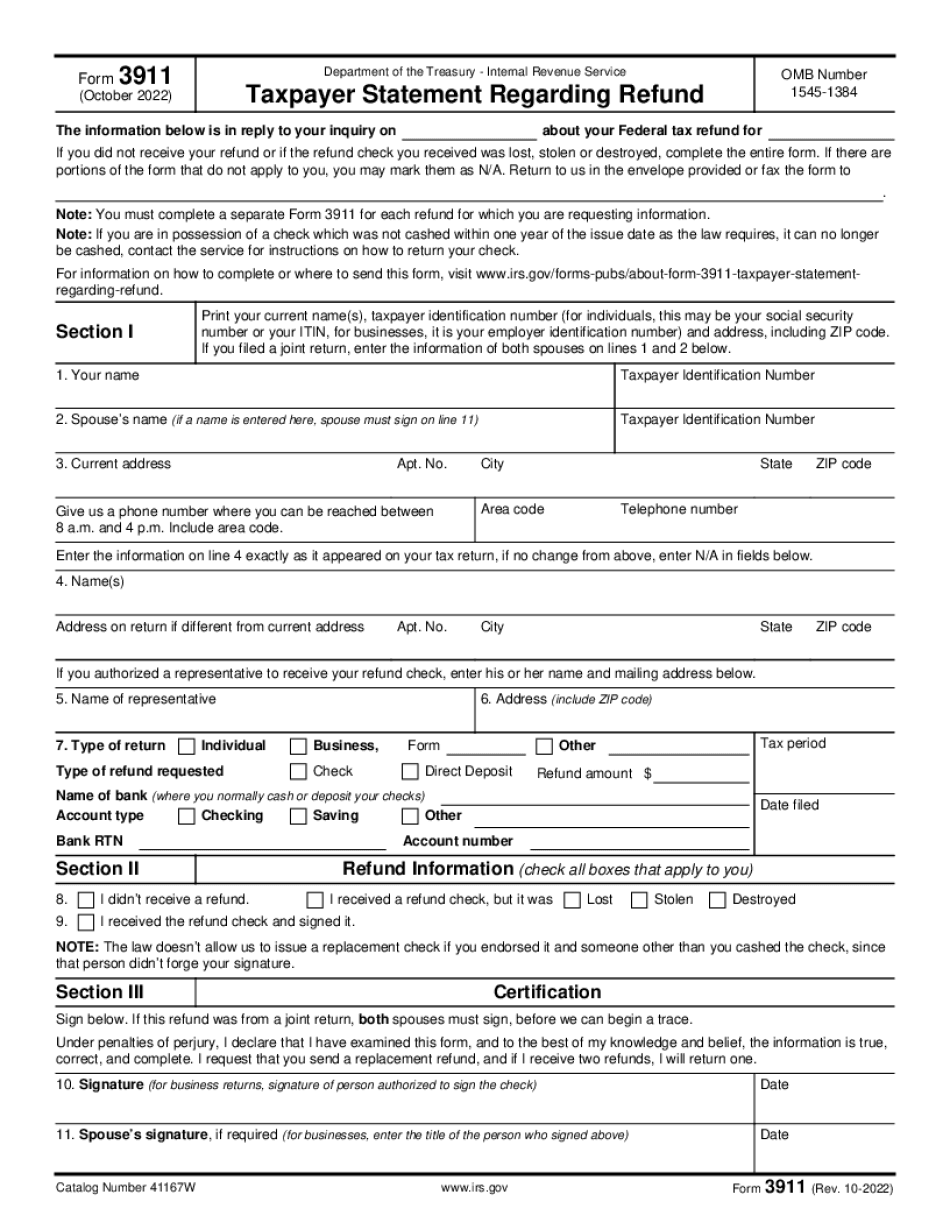

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 3911, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 3911 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 3911 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 3911 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Tax refund check ripped