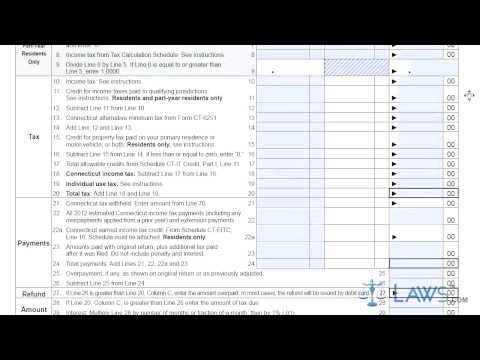

Laws.com legal forms guide provides the CT - 1040x amended Connecticut income tax return form for individuals. This form is used by Connecticut full year and part year residents, as well as non-residents. The form can be obtained from the website of the government of the state of Connecticut. To fill out the form: Step 1: If you filed on a fiscal year basis rather than a calendar year basis, enter the beginning and ending date of the fiscal year at the top of the form. Step 2: Enter your name and social security number, and do the same for your spouse if you are filing jointly. Step 3: Provide your mailing address. If your city, town, and zip code of residence are different, enter the correct information below. Also, include your telephone number. Step 4: Indicate your filing status on both the original return and the amended return by checking the appropriate es. If you are filing the amended return due to federal adjustments or adjustments made by another state, check the applicable es. Step 5: Complete lines 1 through 23 by filling in three columns. In column A, enter the originally reported or last adjusted amount. In column B, enter the net increase or decrease between the original and corrected figures. In column C, enter the corrected figures. Enter your federal adjusted gross income on line one. Step 6: If you have any additions, complete lines 31 through 39 and schedule one on the second page. Transfer the value from line 39 to line 2 on the first page. Add lines one and two, and enter the sum on line three. If you have any subtractions, complete lines 40 through 50 and schedule one. Transfer the value from line 40 to line four on the first page. Subtract...

Award-winning PDF software

Ct tax s 2025 Form: What You Should Know

Tax Rates 2025 Tax Returns — NY. Gov For more information on Connecticut tax return filings, click here. 2018 Connecticut Business Income Tax Credit Program For more information on business income tax credits, click here. Fees You will pay two types of fees: Fee for filing: State fee (60 or more) is paid at the time of filing tax returns. Federal/state fee (15 or more) is based on the taxpayer's filing status and income level, as well as any qualifying items. Additional information For more information on Connecticut tax-related programs, click here.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 3911, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 3911 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 3911 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 3911 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Ct tax forms 2025