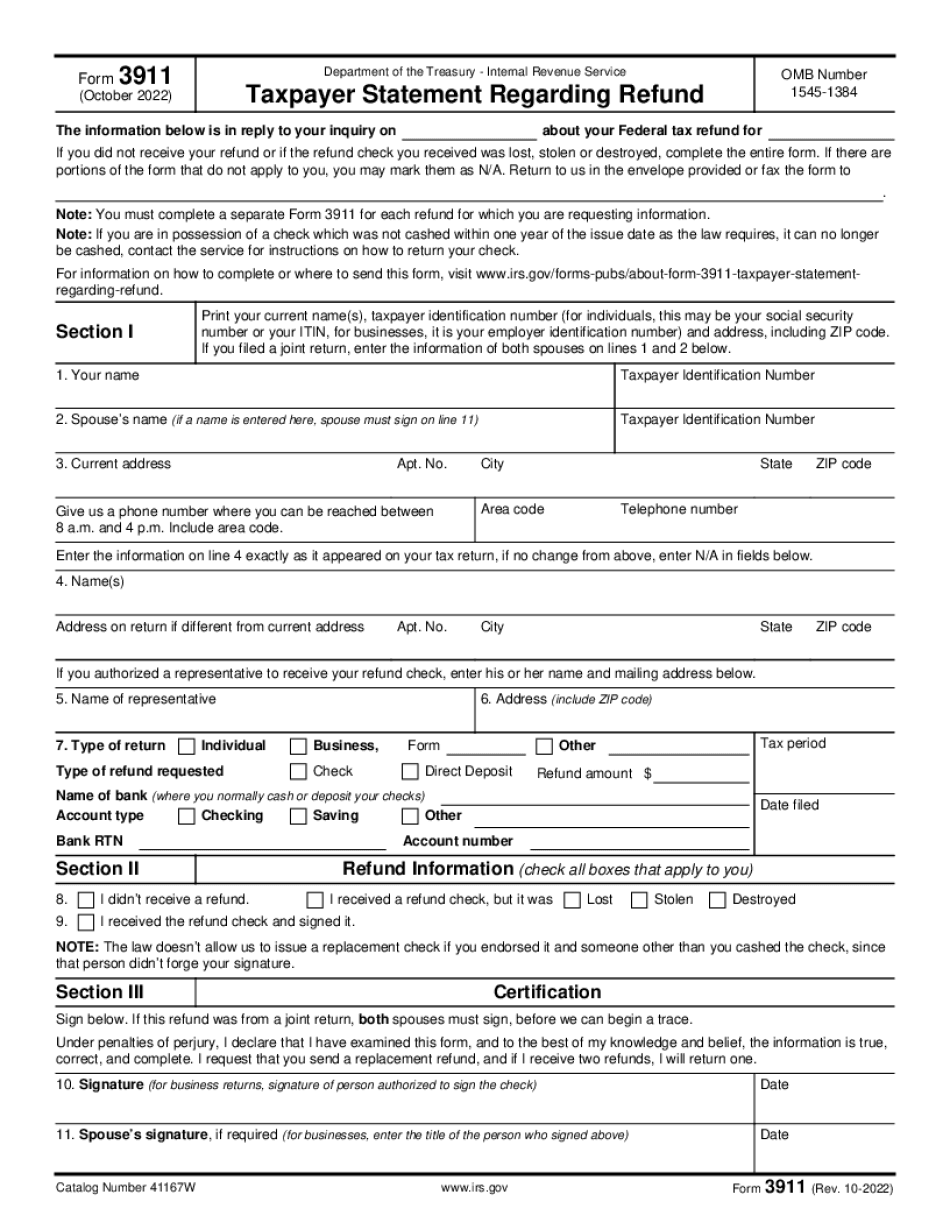

Hi, I'm Mark. If you're expecting a federal tax refund but it hasn't arrived, first check your refund status at irs.gov/refunds. Once you know your official status, you can narrow down what might have happened. If you had your refund sent as a check, it's possible that it was lost in the mail or stolen. Either way, you'll need to report the missing check and have the IRS start a trace by filing Form 3911. Once the IRS determines that the check was lost or stolen, they will let you know how to proceed. If your refund was supposed to go directly to your bank account, the IRS is not responsible if you made a bank account information error on your return. In that case, you'll need to contact your bank or credit union to find out what steps to take. If you have already contacted your bank or credit union without getting any results, you can file Form 3911. The IRS will then contact the institution and try to help. However, please note that the IRS cannot require the bank or credit union to return the funds. For more information, visit etax.com.

Award-winning PDF software

Irs Refund Trace Form: What You Should Know

Letter to Information Commissioner — IRS 21.4.3 Limited Pay ability — IRS 21.4.3.1 Refund Trace. The Service will trace your limited or denied refund. 21.4.3.2 Limited Pay ability information. You will furnish: your address and a phone number where we may call you; the last four digits of your social security number (SSN). (We recommend that you include your SSN to avoid an error in the refund); a statement that you have not filed a federal income tax return; (If you have filed a federal income tax return within the last 5.12.25.4.6.3.4.3.7.4 years, you may provide: (1) If a tax return was filed and received payment from the IRS, but it is not your refund; or (2) If you are seeking a refund of tax you reported to the tax examiner in connection with the assessment or collection of an assessed tax liability, a statement that you are not a U.S. taxpayer; and, (3) if a refund was received after the tax year as estimated by the tax examiner, a statement that you are not a U.S. taxpayer. 21.4.3.3 Personal income tax returns. You will furnish any additional personal income tax returns for the calendar year in which the refund was received. You must also furnish: If the IRS is seeking the refund of one or more taxes as a result of an assessment, the name and address of the taxpayer. Otherwise, you must furnish: the name and address of the taxpayer. The IRS sends us Form 1099-INT, “Income Tax Return Information for Beneficiary,” if we receive a refund from a tax return of the recipient. If the IRS is seeking the refund of one or more taxes or an assessment, the name and address of the taxpayer. Otherwise, you must furnish: the name and address of the taxpayer. Notice: The IRS will review all taxpayer letters sent by the Service and, in determining whether to investigate or deny the request for a refund, the IRS will consider the factors shown in 21.4.3.1. 21.4.3.3.1 A Return Receipt Form that you sent us stating that your refund was received. If you are requesting confirmation of payment, submit the receipt or check receipt for the payment of a tax.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 3911, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 3911 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 3911 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 3911 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs Refund Trace