Here's how it works: crooks use stolen identities to file for a tax return online. Victims have no idea until they try to file their own return. Inspectors say that when filing, identity thieves ask to have their refunds put on a debit card. But in order for them to get the money, they need other people to receive the debit cards in the mail from the IRS. Postal inspectors tracked down one of these middlemen and learned the intricacies of the scam. Once the middleman receives the debit card from the IRS, he sends the card's passwords to the mastermind, who is often overseas. In this case, the go-between was living in a hotel, and an astute employee noticed something unusual. The suspect was receiving numerous debit cards in different names, and the hotel manager noticed that all these debit cards with different names were going to this one room. A search warrant uncovered valuable evidence. They found several debit cards with other people's names on them. They also seized the suspect's computer and recovered over 200 stolen identities. They were also able to recover the chat messages between the suspect and the individuals in Nigeria. Authorities warned the suspect to discontinue his role in this scheme, but he didn't listen. Once they were gone, the suspect went out and purchased another computer and contacted the individuals in Nigeria, telling them that the feds were there and had taken everything. The middleman faced several charges, including obstruction of justice, and was sentenced to 11 years in prison. This case is just a small part of a larger case that is being investigated nationwide. The total loss to date is over a hundred and fifty million dollars. So, this case is hitting a larger portion of the country. The best...

Award-winning PDF software

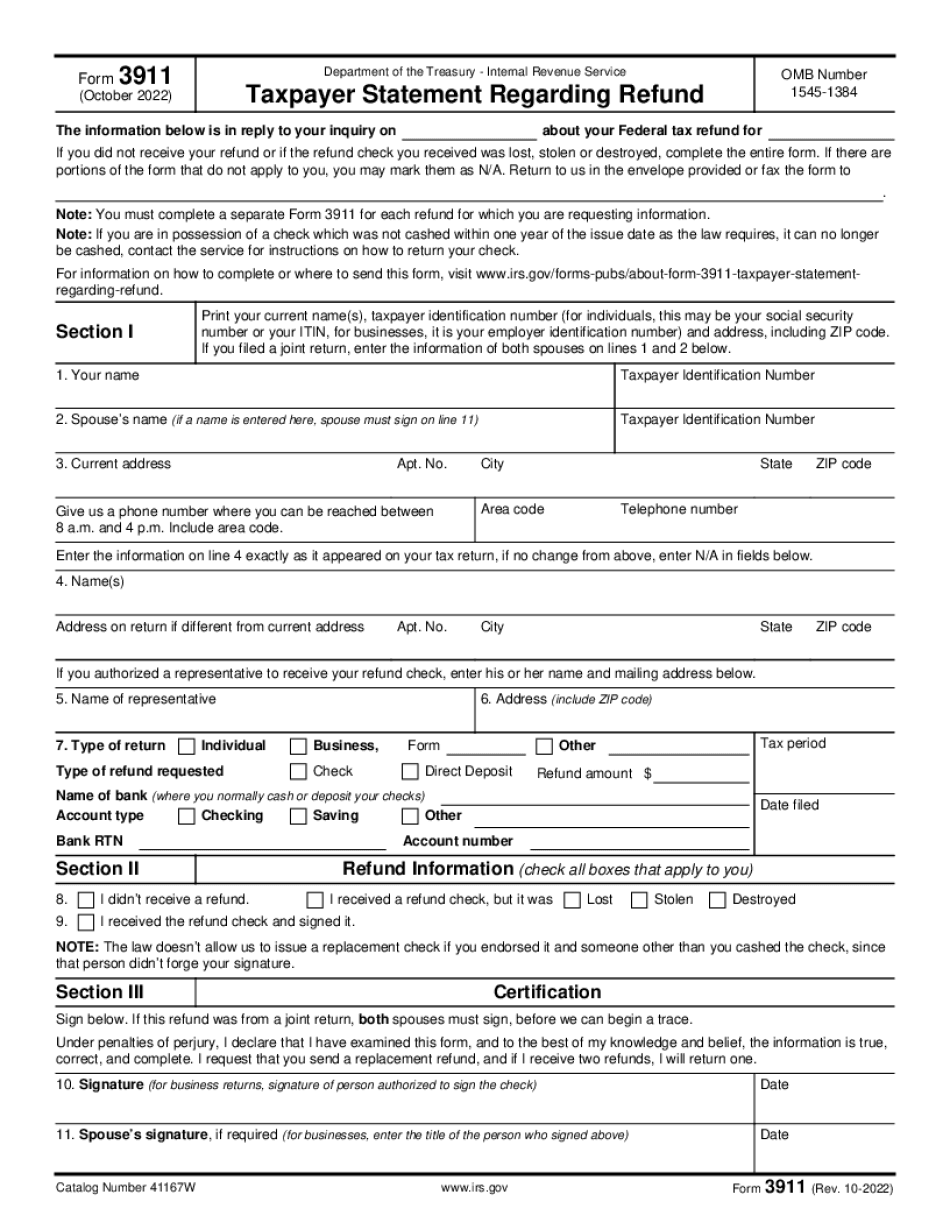

How do i report a Lost Irs Refund Check Form: What You Should Know

What do you do if your refund checks are mailed to you? If you didn't receive the refund check (if you filled the Form 3911), use the following procedure to check on it: Go to . If you did get the check, go to Section I (where you filled in section 1 in Section “1.10” — Form 3911) and check the date your check was delivered to you and the name and address of the person you gave the check to. If you don't know the person, go to Section III (where you filled in section III in Section “4.00” — Additional instructions) and find the line of code that says: “Refund check.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 3911, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 3911 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 3911 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 3911 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing How do i report a Lost Irs Refund Check