Award-winning PDF software

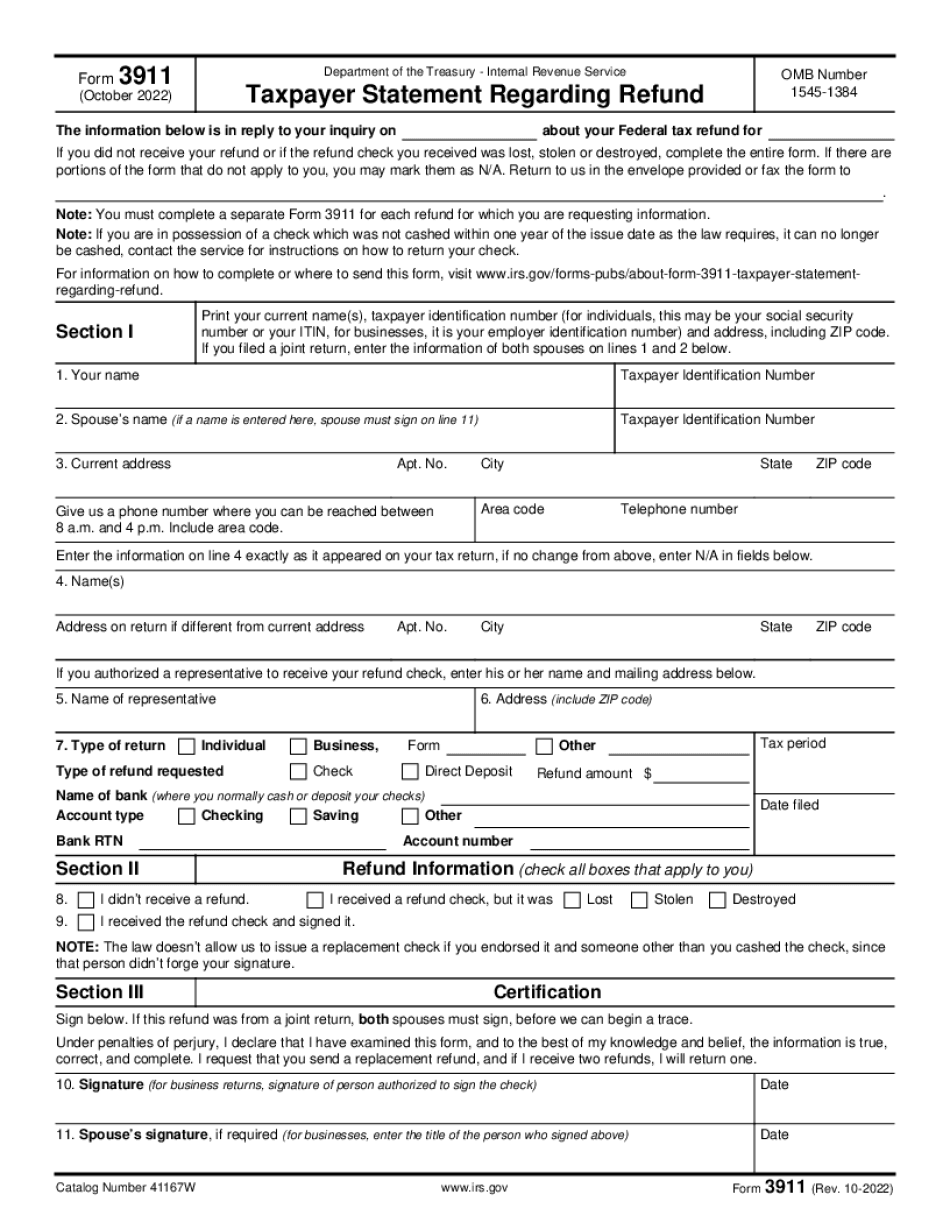

taxpayer statement regarding refund - internal revenue service

January 2018). Department of the Treasury — Internal Revenue. Revenue Service. Individual Taxpayer Refund Program. OMB Number. . (January 2018). Department of the Treasury — Internal Revenue Service. Taxpayer Statement Regarding Refund. OMB Number. . (January 2018). Department of the Treasury — Internal Revenue Service. Individual Taxpayer Refund Program. OMB Number. . (January 2018). Department of the Treasury — Internal Revenue Service. Taxpayer Statement Regarding Refund. OMB Number. . (January 2018). Department of the Treasury — Internal Revenue Service. Taxpayer Statement Regarding Refund. OMB Number. . (January 2018). Department of the Treasury — Internal Revenue Service. Taxpayer Statement Regarding Refund. OMB Number. . (January 2018). (ii) Internal revenue service. (iii) Internal revenue service. (iv) Internal Revenue Service.

About form 3911, taxpayer statement regarding refund - internal

For an explanation of how this Form is not a receipt please visit FAQ #8). If, however, you are filing for refund. Taxpayer Return. You may elect to submit a Taxpayer Return. When must you file a return? To request a refund, you must file a Form 1040X (or Form 1040) by the original filing due date for the tax year, or the extended due date for the tax year plus 10 days. However, if there are any amounts to be refunded that were not included on your tax return, you should file Form 3911 or Form 2106, and the information regarding the tax refund will be sent to you through your regular mail. (For more information, see General Instructions for Forms 1040X, 1040-EZ, 1040A, and 1040NR.) When filing a return online You should select your return type (Online, e-file, or Print-out) and then select Next on the Taxpayer Gateway and/or Next on the.

Form 3911: never received tax refund or economic impact payment

Form 3930 has different income rules for married filing jointly rather for single and qualifying widow(er). 4. The original Form 3911 was dated Dec. 16, 1969, but the current Form 3930 is dated Jan. 5, 1979. 4a. The first line of the form is the filing date of the taxpayer's return. It was Jan. 5, 1979 for the taxpayer, and the filing date for the form has not changed in more than a decade. In the future, the IRS may issue a newer version of the form. 4b. The other line in the form indicates the payment method. The previous version of Form 3931 gave two options--payment by check or wire. The current Form 3931 has only one option-- wire. The old Form 3931 was also available for free on Fabric provides two free forms to taxpayers and provides information regarding the filing deadlines and forms. It is also a good resource.

Form 3911: fill out online | pdf & word | refund inquiries

This form requires taxpayers to identify all income and expenses they receive, whether it is in the form of cash from directors, shareholder interest, dividends and so forth. This information is then submitted to the IRS via mail, fax, telephone or online. I think this form is also known as a “Non-Employer Identification Number(NEN).” Why this Form? You may ask why a “Form 3911” is required of a person to file? The IRS states that this form is created so that a taxpayer can know how much income and expenses they may expect to receive in the future from an income source or interest that they do not pay as income due to their tax situation. They also state that this form is intended to educate individuals about their tax responsibilities, so that they can file their taxes on time. The IRS also stated if the taxpayer fails to complete a Form.

How to fill out form 3911 for a lost stimulus check - youtube

June 16, 2014By default only the first and last month of the subsidy remain available. Any remaining balances go to the federal fund. You must request an extension.