Award-winning PDF software

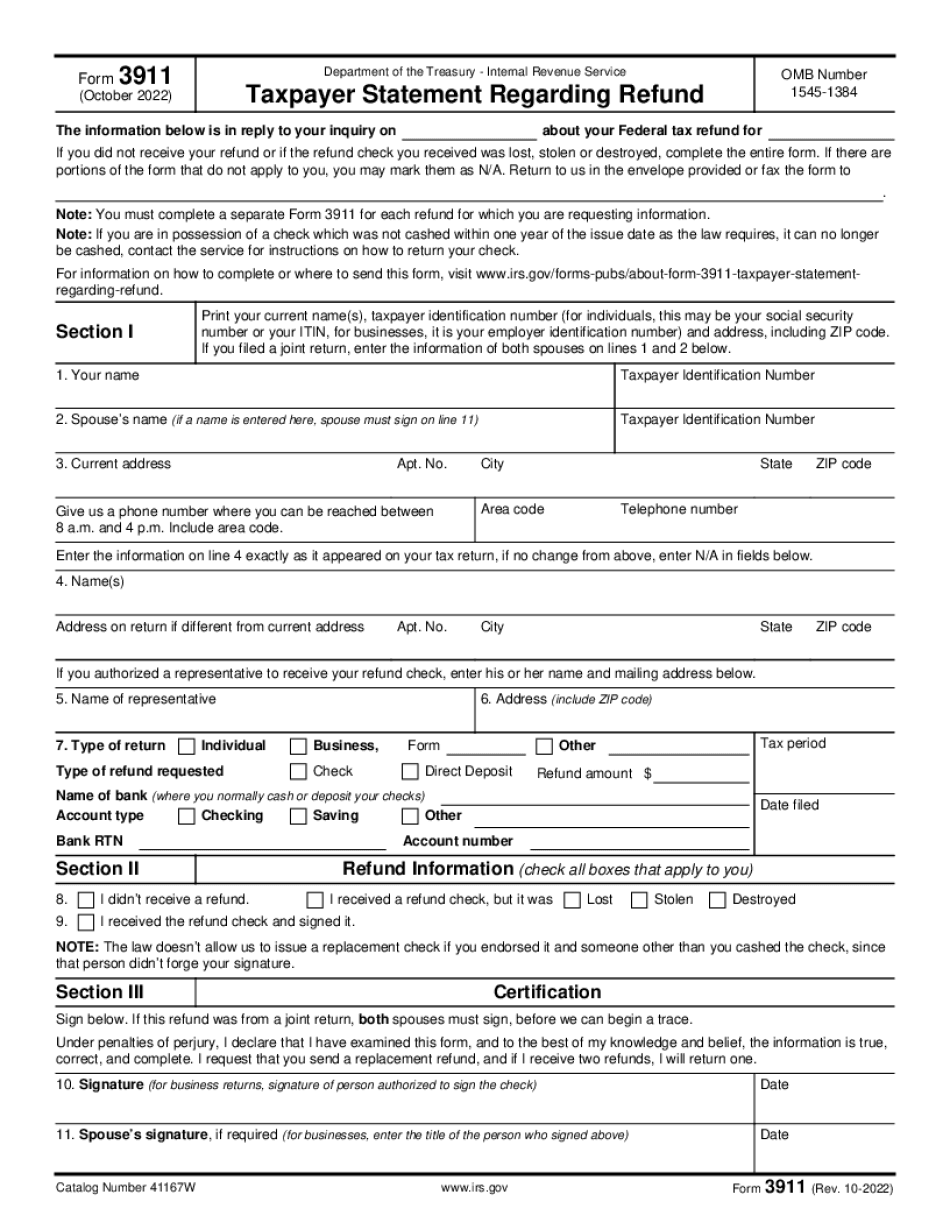

McKinney Texas Form 3911: What You Should Know

Rep. Fort Worth Texas Form 3911 — Provide the information on the new form. I. INTRODUCTION This form can serve as an educational tool for prospective employees, as well as those individuals who are applying for the position. This form also provides information for job seekers, including a statement that is used by the job seeker to confirm whether the information given to them on application is correct. This form also serves as a public service announcement, informing those employees that their employment has been terminated because of a termination agreement. This form provides the information in the Table of Contents so that applicants will be able to quickly and easily determine the contents of the form. The Table of Contents contains three sections; the section titled “What You Need” lists what you need to provide on this form, including the statement, an indication of the type or class of tax returns to which you are filing, and a disclosure for the reason for the termination of employment. NOTE: For individuals to use this form, they must sign the paper application without signing any signatures. There are two ways to sign the application without signing a signature. You can sign your name, or you can sign the application and include your name by typing or typing and signing a signature on your computer or your cell phone. A. What You Need A.1. What You Need A.1A. What You Need This form provides a certification that the tax returns that you've filed before are not substantially similar to the tax returns that are being filed. The requirements of that certification are described in the section of the form titled, “What You Need to Contemplate”. The certification applies only to the tax returns that you've filed before and not to the current tax returns. It will not apply to any current and future tax returns that you file or any tax forms or schedules that you use. The “What You Need to Contemplate” section of this form is explained in more detail below. The certificate is effective for three years and is renewable. If you are making a certification for a nonqualified individual, you must submit a new certification statement for each new taxpayer. You are required to use Form 3911 to file the certificates with the Internal Revenue Service within 30 calendar days from when you get the application packet. If you do not file Form 3911 on the 30th day, then you must amend your tax return to correct the information previously reported on Form 1040.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete McKinney Texas Form 3911, keep away from glitches and furnish it inside a timely method:

How to complete a McKinney Texas Form 3911?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your McKinney Texas Form 3911 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your McKinney Texas Form 3911 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.