Award-winning PDF software

ID Form 3911: What You Should Know

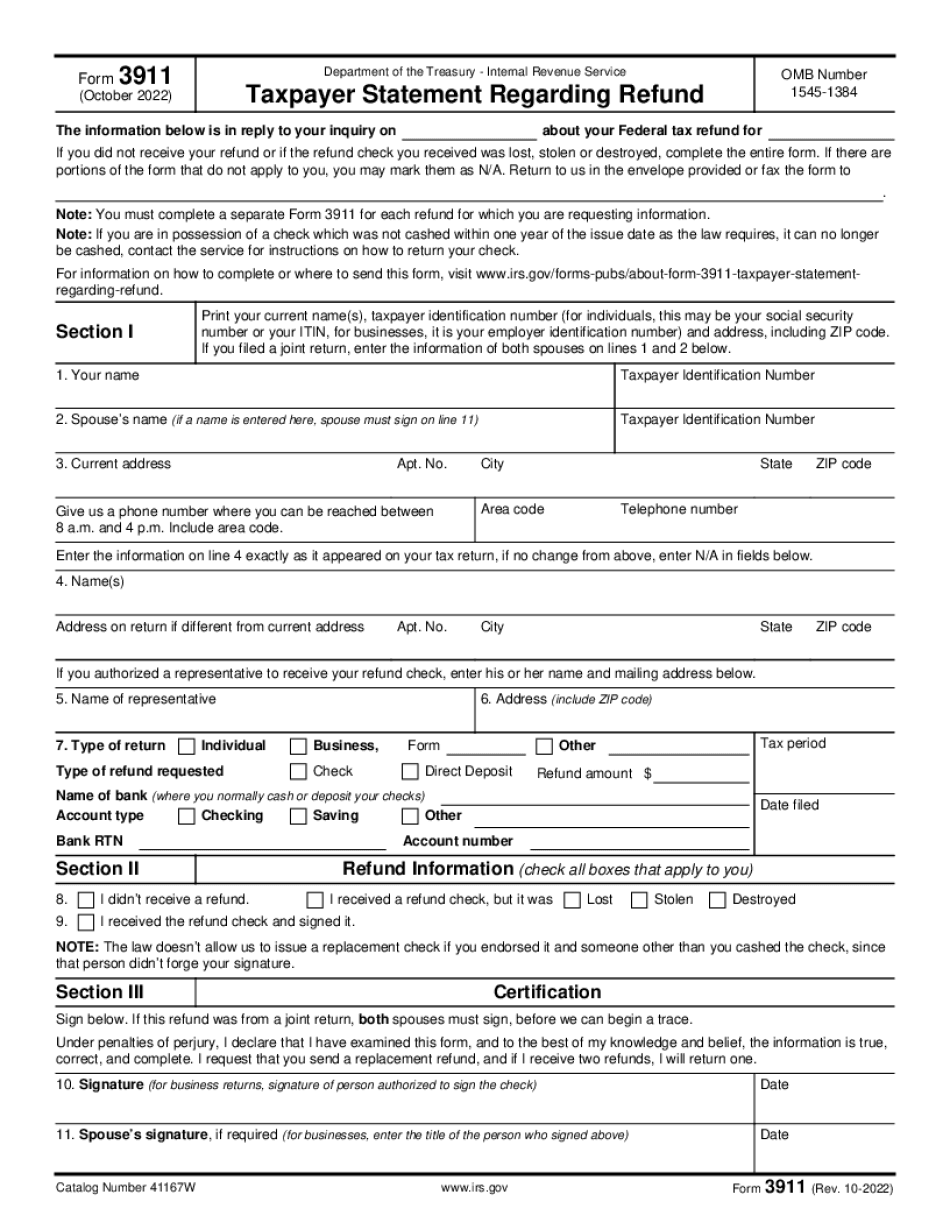

Feb 25, 2021- IRS releases a new version of Form 3911 (IRS Form 3911/S-2); This is an amended version of Form 3911 from January 2016. Form 3911: Not Received Tax Refund IC Title: Form 3911 — Taxpayer Statement Regarding Refund, Agency IC Tracking Number: ; Is this a Common Form? Yes, IC Status: Modified. Form 3911: Not Received Tax Refund This is NOT a taxpayer return. This document is not intended for IRS use. If you have questions about IRS Form 3911, please contact the Taxpayer Services Contact Center or return this page. IC Title: Form 3911 — Taxpayer Statement Regarding Refund, Agency IC Tracking Number: ; Is this a Common Form? Yes, IC Status: Modified. This form is currently maintained as an open book, which allows other users to add and update information, but does not allow individuals or businesses to add any information. This is NOT a taxpayer return! A taxpayer returns this document, not a document that contains your tax information. The taxpayer should file this document in the tax year that it is required to file by law. The taxpayer should also consider the importance of the statement in determining the amount of tax. This is NOT a taxpayer return! A taxpayer returns this document, not a document that contains your tax information. The document that you are viewing is an individualized tax return form that must be filed by each individual who is required to file an individual tax return. The taxpayer completed a Taxpayer Statement Regarding Refund. Information about the statement includes: · Taxpayer Identification Number · Name · Address · Date of Birth What if you cannot accept my response? If you believe that any of the information provided in this response is not accurate because it is outdated or incorrect, contact us, so we can make corrections. Please reference the IRS Taxpayer Information FAQ: What if the information I provided on the taxpayer return I prepared was not accurate, complete, or timely. It is the taxpayer's responsibility to provide all the required information on a return. It is the taxpayer's responsibility only if the form includes an acknowledgement of a refund request, Form 5975, Electronic Payment by Mail, or Form 4868, Electronic Bank Statement. IT IS THE TAXPAYER'S RESPONSIBILITY to ensure that the information in this response is accurate and current.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete ID Form 3911, keep away from glitches and furnish it inside a timely method:

How to complete a ID Form 3911?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your ID Form 3911 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your ID Form 3911 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.